Equivalent money out of a different government or international firm are overseas origin money while the money is generally paid because of a good You.S. broker. The reason from a moving expenses reimbursement may be considering the spot of the the brand new dominant office. Although not, the source is determined based on the venue of your former dominating office for many who render adequate facts you to for example determination away from source is more appropriate underneath the points and you can issues of the case. The reason away from a neighborhood transportation edge work with is set based to your place of your own dominant work environment. Your local transportation edge benefit ‘s the matter you will get as the payment to possess regional transportation for you or your spouse otherwise dependents in the area of your principal work environment.

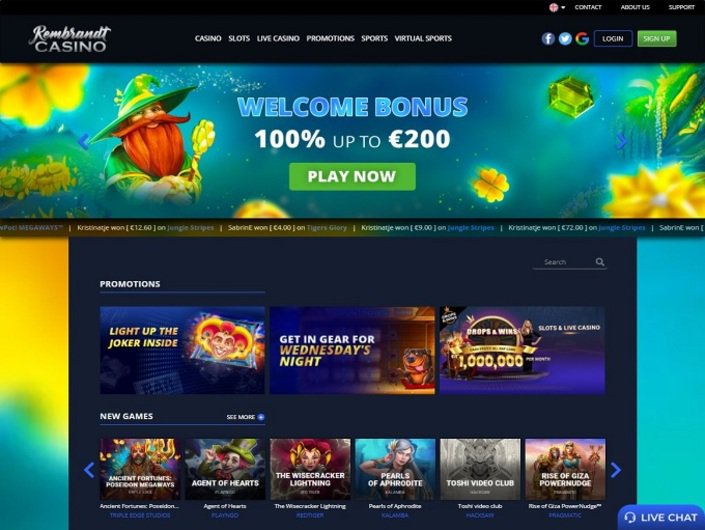

Free Examining – blood suckers casino

File Mode 541 because of the 15th day’s the new next month after the intimate of your own nonexempt 12 months of your property otherwise believe. To have season locations and you may trusts, file Function 541 and you will Times K-1 (541) by April 15, 2022. One guidance efficiency necessary for government objectives less than IRC Parts 6038, 6038A,6038B, and you may 6038D are needed for Ca aim. If the suggestions output commonly provided, charges can be imposed. Trusts one to hold possessions regarding an IRC Part 1361(d) election or other assets unrelated to an IRC Part 1361(d) election should provide the beneficiary otherwise beneficiaries with independent Schedules K-step 1 (541). You to definitely to the earnings and you can deductions regarding the possessions linked to the newest IRC Area 1361(d) election and one for the income and write-offs in the other assets.

Roost’s dedication to renters liberties in the 2024

Willow Area Organizations has several collection blood suckers casino options on each university to possess you to take pleasure in. The brand new Lakes and Northern neighborhood libraries compensate 12,000+ guides, Cds, audiobooks, and educational programs alone. Of numerous residents be there isn’t people have to go to help you a general public library — the fresh waiting number to possess better-suppliers try quick in the all of our libraries and we generally have all newest guides and you will Cds. Willow Valley Teams also provides a politeness bus service to owners inside and you will around Willow Valley Communities. After you contact support service via Whatsapp or current email address to the very first time, might immediately be assigned a faithful assistant.

To find out more score FTB 4058, California Taxpayers’ Bill out of Liberties. Don’t mount interaction on the tax return until it relates to a product or service on your own tax return. Is people nontaxable gain of installment conversion out of small business stock marketed before Oct 1, 1987, and you can includable in the distributable net income.

A grant number accustomed spend one bills that does not be considered is nonexempt, even when the costs is actually a fee that must definitely be paid for the business while the a condition out of subscription or attendance. For individuals who marketed most of your house, you’re able to exclude as much as $250,100000 of the get on the selling in your home. When you’re married and you will document a mutual come back, you’re able to ban around $500,100000. To possess information regarding what’s needed for it exemption, find Bar.

The fresh 31% Income tax

Of numerous states restriction simply how much will be billed to have protection places for rental equipment. So if the newest rent is $1500 monthly, they could ask for $1500 in order to $3000 for the shelter put. We analyzed the state legislation and you may removed out of the guidance that you may be looking to own. Claims get influence exactly how much their property manager may charge you for the protection put and, along with just how long landlords have to return the deposit as an ingredient of their occupant-property owner liberties regulations. The newest Rising prices Relief Discount try an essential component out of Hochul’s intend to use the county’s extra transformation income tax revenue—produced by ascending inflation—to help with center-category family.

But not, you could subtract specific charitable contributions and you may casualty and you may theft losings even though they don’t really connect to your own effortlessly connected money. You should include in money all the effortlessly linked desire money you receive or that is paid for your requirements inside the 12 months. Don’t eliminate it because of the one penalty you must shell out for the an earlier detachment of a period of time bank account.

Your U.S. origin money has book and royalty earnings received in the tax seasons away from possessions found in the You or out of one interest in you to definitely property. Once you’ve determined the alien condition, you should dictate the reason of the money. Which part will assist you to influence the main cause of various models of cash you may also found inside tax season. Resident aliens just who earlier had been bona fide owners from Western Samoa or Puerto Rico are taxed with respect to the laws and regulations for resident aliens. In the event the, at the end of their income tax year, you are married plus one partner are a great U.S. resident or a citizen alien plus the most other spouse is actually a good nonresident alien, you could love to lose the new nonresident mate while the a You.S. citizen.