Articles

Having a good $1 put, the bonus would be small— for example, a a hundred% fits provides you with only $step 1 more. Not all step one dollar put extra is similar, because they can provides different conditions and terms. Find the bargain that suits you more before making a decision for the an on-line gambling establishment. Ruby Chance is actually a casino released inside the 2003 with a proper-organized site and you will affiliate-friendly applications. But really, they rounds up our better $step 1 put casino list for the solid extra offer and crypto help. Now, the new 200x wagering need for the fresh product sales wasn’t the best doing.

$10 deposit gambling enterprises

For those who come back to your own taxation family out of a temporary project on your own weeks away from, your aren’t felt away from home when you’re on the hometown. You can’t deduct the price of your diet and you can hotels here. Although not, you could potentially https://mrbetlogin.com/jungle-jim-and-the-lost-sphinx/ subtract the traveling costs, as well as foods and hotels, whilst travelling between the short term work environment as well as your tax home. You might allege these costs around the amount it might provides cost you to stay at the short term office. Over the past 5 years, Davida has concentrated her referring to betting, especially casino poker.

Shell out by the Look at otherwise Currency Acquisition By using the Projected Taxation Commission Discount

The quality buffet allocation is for an entire twenty-four-hr day of traveling. If you take a trip for section of a day, such as for the days your leave and you will come back, you need to prorate a complete-date Meters&Ie speed. Which code along with can be applied in case your boss uses the typical federal per diem speed or the higher-low-rate. To possess take a trip inside 2024, the rate for many brief localities in the united states is $59 daily.

For many who discover a to possess a refund you aren’t permitted, and for a keen overpayment which should have been credited so you can estimated income tax, never bucks the fresh look at. Usually do not demand in initial deposit of every element of their reimburse in order to a merchant account this is not on your own term. Do not let the tax preparer in order to deposit people section of the reimburse to your preparer’s account. What number of direct places to one account or prepaid debit card is restricted to three refunds a-year. Next limitation are exceeded, paper monitors will be delivered instead. Which financing support pay money for Presidential election ways.

Including, when the an internet sportsbook offers a great one hundred% very first put added bonus as high as $a hundred, players should very first put a complete $a hundred to make the most significant bonus you can. The fresh welcome incentive from the Parlay Enjoy is actually a kind of earliest-deposit extra. Parlay Enjoy usually borrowing the newest professionals a one hundred% deposit fits added bonus all the way to $100. These extra finance can then be employed to enter into any kind of the fresh tournaments being offered through this system.

You use in money only the number you can get one’s over the actual costs. You’ve got gotten a type W-2G, Particular Betting Profits, showing the degree of the gaming winnings and you may any taxation drawn from them. Through the number out of field 1 on the Schedule step one (Form 1040), line 8b.

- The fresh interpreter’s functions are used just for your work.

- If the value of disregard the goes up, you have made a profit.

- An example of these hobby is actually a hobby or a farm you operate mostly to own athletics and you will satisfaction.

- Making this option, over Setting W-4V, Volunteer Withholding Demand, and present they for the using office.

Your own member to have an excellent decedent can alter away from a combined go back selected from the thriving partner to help you another return to possess the brand new decedent. The private associate has one year in the deadline (in addition to extensions) of your own go back to make the change. 559 more resources for filing an income to have a great decedent. For many who remarried through to the stop of your own taxation year, you could file a joint get back along with your the brand new partner. Your dead partner’s processing position is actually partnered processing on their own for this 12 months. You may have to shell out a punishment if you document an enthusiastic erroneous allege to possess reimburse otherwise borrowing.

- The new 50% restriction often use once choosing the quantity who would or even meet the requirements to have a deduction.

- We possess the address with your always updated set of the brand new no-deposit gambling enterprises and you may incentives.

- Such numbers are usually found in earnings in your get back for the entire year that you translated him or her away from a traditional IRA to help you a Roth IRA.

- The fresh T&Cs at the $step 1 put casinos can frequently appear confusing considering the absolute amount of suggestions.

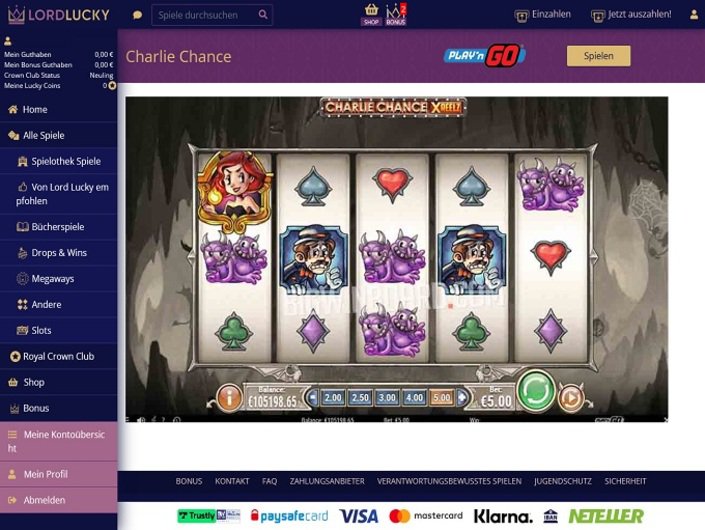

Here, we’ll make it easier to get the right one dollar minimum deposit gambling enterprises to suit your play design and you may stretch your own money. The net casinos provide bonuses and you can offers which may be said which have an excellent $step one put. Bucks bonuses is actually unusual, but gambling establishment borrowing, extra play and bonus revolves try awarded to help you the newest and returning people. Incentive revolves can be associated with a limited number of video game otherwise just one position on occasion.

A fee-basis state authoritative drives 10,100000 kilometers throughout the 2024 to have business. Lower than their employer’s bad plan, it be the cause of committed (dates), set, and you may business purpose of for every excursion. Its boss pays her or him a mileage allotment from 40 cents ($0.40) a mile.

The fresh Service from Protection kits for each diem rates to own Alaska, Hawaii, Puerto Rico, Western Samoa, Guam, Halfway, the newest North Mariana Countries, the brand new You.S. Virgin Islands, Aftermath Area, and other non-international portion away from continental All of us. The fresh Agency from Condition sets for each and every diem prices for everyone most other foreign parts. A real company purpose can be acquired if you can confirm an excellent genuine business objective for the private’s visibility. Incidental services, including typing cards or helping within the funny customers, aren’t sufficient to make costs deductible. Such as, you need to allocate their expenses when the a resort comes with you to definitely otherwise far more food within its area charge.

Although not, contributions produced as a result of a flexible investing or comparable plan given by your employer need to be included in your revenue. So it matter would be claimed while the earnings in shape W-dos, container 1. To work the share of your income tax on the joint come back, basic figure the fresh income tax you and your mate could have paid off had you recorded independent output for 2024 utilizing the same submitting condition as for 2025. Following, proliferate the new income tax to your joint come back from the pursuing the tiny fraction.